-

Gallery of Images:

-

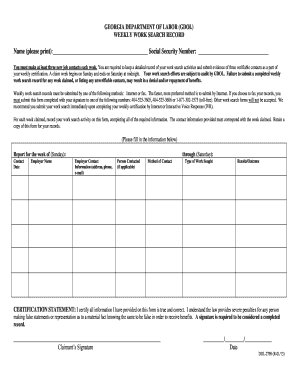

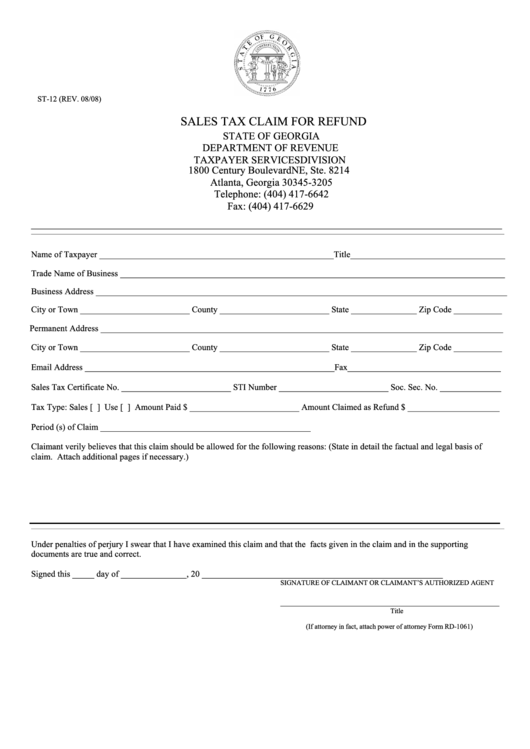

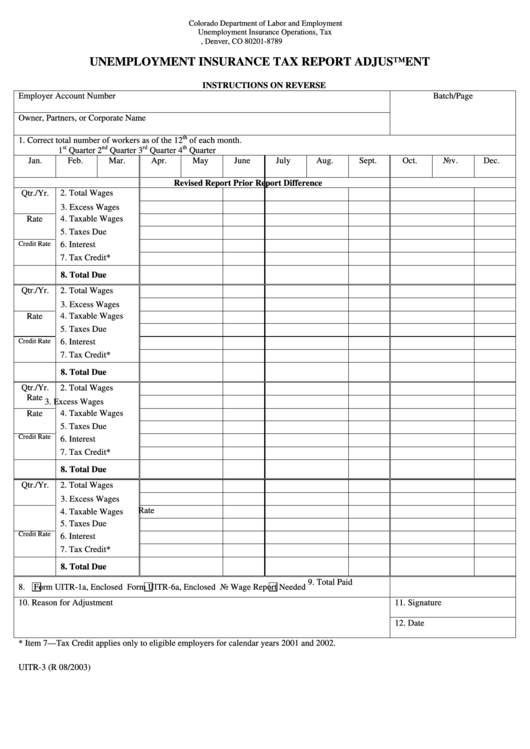

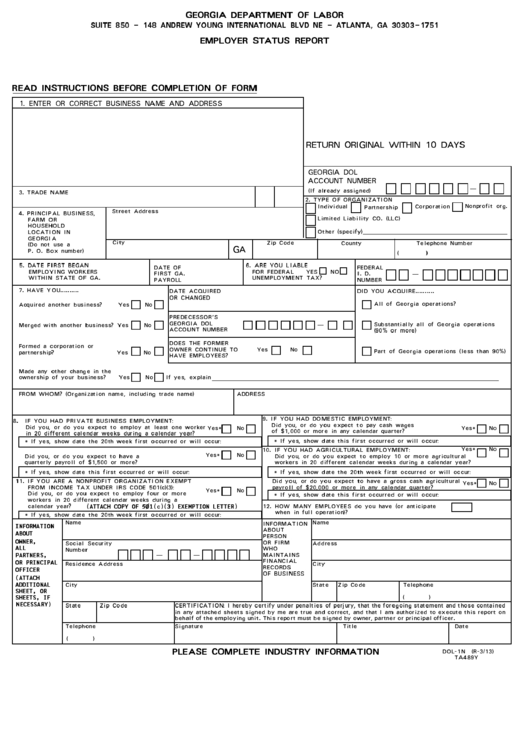

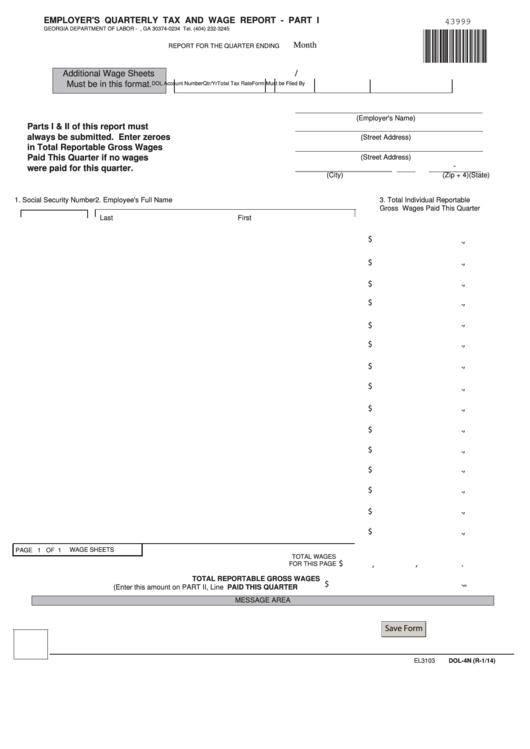

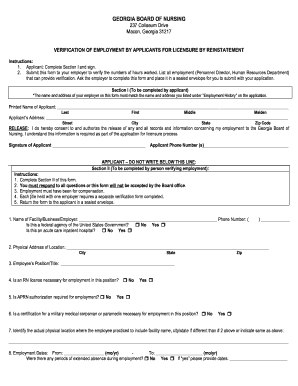

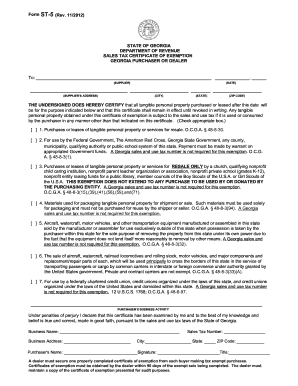

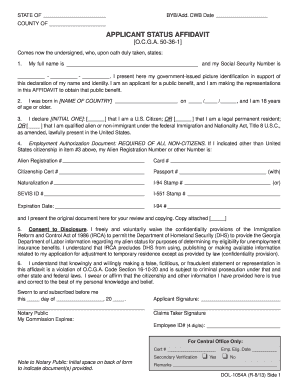

The Georgia Department of Labor's agricultural policies and contacts for state and national agricultural resources. Annual tax and wage report which domestic employers must file. The annual report and any payment due must be filed on or before January 31st of the following year to be considered timely. This form is interactive and can be. The job of a tax specialist is to keep up to date on all of the newly updated as well as the outdated laws. A great resource for information on Georgia tax forms is They offer some of the best advice and forms that you could ask for. GEORGIA DEPARTMENT OF REVENUE BACK TAX RELIEF Get started resolving your state tax liabilities using the information below. If you still need help, reach out to us using the contact form to the right of this page. State of Georgia Department of Revenue Instructions 1. Download (free) the latest version of Adobe Reader. Form G7MUST be filed, even if no tax was withheld for a particular quarter or if payment was made via EFT. Georgia Department of Revenue Processing Center P. A correctly file tax report eliminates the possibilities of future penalties and interest from the state of Georgia and the federal government as well. Form DOL 4N is submitted to the Georgia Department of Labor to submit employment tax information and payment. Some time between January 3 2011 and January 31 2011 You would really have to contact the state of Georgia tax department to see if and when the 1009G will be made available to you and if it would be available to you online and if so how to access it the 1099G online. State Form; District of Columbia (Select the WH4 form) Iowa. IA W4 Withholding Certificate IA Withholding Monthly Deposit. Bureau of Labor Statistics Division of Human Resources, PSB Suite 4230, 2 Massachusetts Avenue, NE Washington, DC. CM972 (Form Name Application for Approval of a Representative's Fee in a Black Lung Claim Proceeding Conducted by The U. Department of Labor; Agency Office of Workers' Compensation Programs Division of Coal Mine Workers' Compensation) The principal tax collecting and tax law enforcement agency for the state, the Georgia Department of Revenue offers information about taxes for individuals, corporations, and tax professionals. tax exemption certificates to qualified agriculture producers. Effective January 1, 2013 the Department of Agricultures GATE (Georgia Agriculture Tax Exemption) Certificate will replace Form STA1. I applied through college or university. I interviewed at Georgia Department of Labor (Atlanta, GA) in February 2014. The rate for the subsequent tax years, if increased, will be set by the Commissioner of the Department of Revenue and will be published by August 31. Where do I apply for my title and pay TAVT? The application for title and TAVT payment must be submitted to the county in which the purchaser registers the vehicle (i. The Georgia Department of Economic Development (GDEcD) is the states sales and marketing arm, the lead agency for attracting new business investment, encouraging the expansion of existing industry and small businesses, aligning workforce education and training with indemand jobs, locating new markets for Georgia products, attracting. Atlanta, Georgia Phone (404) Fax (404) SERVICE PROVIDER QUARTERLY TAX AND WAGE REPORTS I understand that all notifications to the employer, with the above Georgia Department of Labor account number, will be. To get started, select your type of vehicle from the drop down menu. The Georgia Unemployment Tax Rate for NEW businesses is 2. 7 on the first 9, 500 in wages paid to each employee in a calendar year. In addition, businesses need to pay Federal Unemployment Tax commonly called FUTA Tax. Download 2017 Individual Income Tax Forms. Learn about the Withholding tax guidelines for the Georgia Department of Revenue. Depreciation and amortization and information on listed property. 500 Individual Income Tax Return. Form 500 for Georgia Individual Income Tax Returns. Information on sales and use tax information for the state of Georgia. A frivolous return is defined by the Georgia Department of Taxation as one that doesn't have the necessary information to calculate the tax due or one with information that reflects a significantly incorrect tax, and the return was determined to be done with the motivation to hinder Georgia Tax Laws or is based on a frivolous position. Complete the form and mail original form to the Georgia Department of Labor. Information Needed to Complete the Forms. Business Name, Address, and Current Georgia Department of. Georgia Department of Labor PREVAILING WAGE REQUEST FORM Please Return To: WIA PW Unit No prevailing wage determination for labor certification purposes made Prevailing Wage Request Form, the following additional guidelines are suggested: a. Georgia Department of Labor Employers Quarterly Tax and Wage Report Hawaii Employer's Quarterly Wage, Contribution and Employment and Training Assessment Report (Form UCB6) Attached you will find the Department of Public Safety Background Packet consisting of a PreEmployment Questionnaire, Personal Data Form and Authorization for Release of Personal Information, along with instructions for each. United States Department of Labor. A to Z Site Map Demographic and Administrative Forms for New Employees; Form Number (if applicable) Form Description (for Bureau of Labor Statistics new employees only) W4. Federal Withholding Form State Tax Withholding Forms. FMS2231 Fast Start Direct Deposit. Make check or money order payable to Georgia Department of Labor and provide your DOL account number on your check. Applicable changes made in your business should be reported in Items AD at the bottom of Part II of the form. Create an account and rsum to take full advantage of Employ Georgia FocusCareerExplorer and to manage your job search in one location. Employ Georgia allows you to: Create or upload up to 5 rsums; The Georgia Department of Labor is an Equal Opportunity EmployerProgram. Senior Tax Expert Jan 24, 2011, 01: 27 PM Log onto the Georgia Department of Labor website; you should be able to download your Form 1099G from there. employer's quarterly tax and wage report part ii georgia department of labor p. (404) report for 1099 misc 2017 form Attention: Copy A of this form is provided for informational purposes only. This form used to submit quarterly employee wages, tax information, and account changes. This form is interactive and can be completed electronically and printed. Chrome and Firefox users must change their default PDF viewer, as Adobe Acrobat Reader is required. Vehicles identified in the Georgia Department of Revenue motor vehicle valuation data base have a fair market value calculated by averaging the current wholesale and retail values of the motor vehicle pursuant to O. Request for Transcript of Tax Return. Employee's Withholding Allowance Certificate Georgia State Website. Small Business Events in Your Area Secretary of State Corporations Division Department of Economic Development. Department of Labor Unemployment. Make check or money order payable to Georgia Department of Labor and provide your DOL account number on your check. Applicable changes made in your business should be reported in Items AD at the bottom of Part II of the form. Uploaded by Department of Labor. Department of Labor: 3c 3 4 of the Employer s Quarterly Tax and Wage Report, Form DOL4 being corrected. Line 7: Enter total of Line 4 through 6. If the total reflects an increase in tax due, make check payable to Georgia Department of Labor. Register With the Department of Labor As a Georgia employer, your small business must establish a Georgia UI tax account with the Georgia Department of Labor (GDOL). To register for an account with the GDOL, use Form DOL1A, Employer Status Report. Apply for a Georgia state tax account with the Georgia Department of Revenue using Form CRF002 Apply for a Georgia state tax account with the Georgia Department of Labor using Form DOL1A Complete and file a New Hire Report with the Georgia New Hiring Reporting Program GEORGIA DEPARTMENT OF REVENUE REGISTRATION LICENSING UNIT P. BOX ATLANTA, GEORGIA completed, the applicant will receive a letter requesting the completion of this form. NOTE: If yes to any of the above, list previous State Tax Identification. View, download and print Dol4n Employer's Quarterly Tax And Wage Report Georgia Department Of Labor pdf template or form online. 2 Dol4 Form Templates are collected for any of your needs. GEORGIA DEPARTMENT OF REVENUE IFTA registrations through the Georgia Tax Center web application. zip code and specific payment amount that was paid for a prior tax period. The Department will issue IFTA licenses and decals as online applications are received. The Georgia Department of Labor (DOL) helps to maintain a strong workforce by providing services to jobseekers and employers. You can file an unemployment claim with the DOL or look up information about finding a job or statistics on Georgias labor market. The Georgia Department of Labor matches qualified job seekers with employers and collects data to help businesses, economic developers, planners, and the workforce make quality workrelated decisions. From offering the Work Opportunity Tax Credit, which provides substantial tax benefit to employers who hire eligible workers, to administering the Unemployment Insurance system that supports the. tax return last year and the amount on Line 4 of Form 500EZ or Line 16 of Form 500 was zero, and you expect to file a Georgia tax return this year and will not have a tax liability. You can not claim exempt if you did not file a Georgia income Looking for Georgia state tax information? We provide the latest resources on state tax, unemployment, income tax and more. Georgia Department of Revenue Georgia Department of Labor. Withholding Requirements: Register as employer by filing Form DOL1A (Employer Status Report). The Georgia Agriculture Tax Exemption program (GATE) is an agricultural sales and use tax exemption certificate issued by the Department of Agriculture that identifies its user as a qualified farmer or agricultural producer. employer's quarterly tax and wage report part ii georgia department of labor p. not file a Georgia income tax return for the previous tax year. requires you to complete and submit Form G4 to your employer in order to have tax withheld from your wages. To qualify for the tax benefit, companies must first receive certification from Georgias Department of Labor, which administers the program in Georgia. Contact GDEcD To get help expanding or relocating a business in Georgia, contact the Georgia Department of Economic Development or call. Form Dol4n Employer's Quarterly Tax And Wage Report Georgia Department Of Labor Form Dol402a Mass Separation Notice List Of Workers Georgia Department Of Labor Form Dol8498 Employer Application For Internet Password Georgia Department Of Labor.

-

Related Images:

%201.jpg)